Jenna Ellison, Head of Family Law at Burd Ward Solicitors has had a text book published. The text book is aimed at CILEX students, but is available for all to purchase.

Working in Family Practice begins by introducing some key family law themes and then discusses the important issue of funding of family law proceedings. The course book then goes on to review the law relating to marriage and civil partnerships. The law and procedure for divorce and dissolution of a civil

partnership is then explained and the differences with judicial separation are outlined. The rights of cohabitants when relationship ends are also reviewed. Next, the book discusses Private Law Children, focussing on the application of the Children Act 1989 to the resolution of disputes between parents. Public Law Children is explained and the role of the state in child protection cases is described. Finally, the course book reviews the law relating to domestic abuse, including the requirements of the Domestic Abuse Act 2021.

This course book is suitable for paralegals and junior staff working in family practice teams, as well as for junior legal staff working in child protection teams in local authorities.

Jenna has been working with CILEX in varying roles over the last year. The Journey to creating this book started over five years ago. Jenna began teaching Level 3 Family Law and Level 6 Family Practice with The Law Academy, based in Liverpool. “I really enjoying teaching, I am really passionate about family law and teaching allows me to pass on this passion with the lawyers of the future”.

Jenna then got involved with CILEX directly with the apprenticeship program. Jenna has assisted in the development of what the role of an apprenticeship would involve, what they generally be involved with assisting a family team. In addition, creating example portfolios so that training providers are assisted with the standards expected.

This role lead to involvement with other programs. Jenna was then commissioned to assist with the syllabus drafting

and exam writing. This naturally led onto Jenna being commissioned to edit the text book that sat along this program. “It has been a real honor to write this text book, I was once told everyone has a book inside them, little did I know, mine would be a family law text book”.

Jenna Ellison, a solicitor and head of our family law department re-joined Burd Ward Solicitors in 2022 having initially trained with us back in 2015.

A lecturer and author, Jenna brings with her a wealth of experience and knowledge from her previous experience working in a city firm to the Family department. Jenna has previously represented both males and females who have been victims of domestic violence and has supported them obtaining orders to protect not only their own safety, but that of their children and home.

Jenna is also very experienced in dealing with Private law proceedings where there is a dispute between the parents regarding where the children should live and when they should spend time with the non resident parent. Jenna’s experience representing children have allowed her to assist both parents come to a child focused arrangement. Jenna has also had experience acting for both Fathers and Mothers when children have not been returned and offers an approach that is timely and professional.

For assistance in all aspects of of family law please contact Jenna Ellison on 0151 639 8273 or by emailing her directly at je@burdward.co.uk

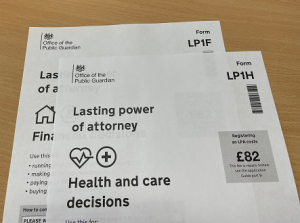

In life, preparation for the future is as crucial as managing the present. At Burd Ward Solicitors, we understand the significance of forward-thinking, especially when it involves legal matters that affect you and your loved ones. A critical component of such planning is understanding and setting up a Lasting Power of Attorney (LPA).

In life, preparation for the future is as crucial as managing the present. At Burd Ward Solicitors, we understand the significance of forward-thinking, especially when it involves legal matters that affect you and your loved ones. A critical component of such planning is understanding and setting up a Lasting Power of Attorney (LPA).

A Lasting Power of Attorney is a legal document that allows you to appoint one or more people (known as ‘attorneys’) to make decisions on your behalf. This arrangement becomes particularly important if you become unable to make your own decisions due to reasons such as illness, an accident, or diminished mental capacity.

There are two types of LPAs in the UK:

Creating an LPA involves several steps, including choosing your attorney(s), filling out the relevant forms, and registering the LPA with the Office of the Public Guardian. It’s essential to consider who to appoint carefully, as they will have significant control over your affairs

At Burd Ward Solicitors, we specialise in providing expert advice on LPAs. We can guide you through the process, ensuring that your LPA reflects your wishes and is legally robust. Our team can help with:

A Lasting Power of Attorney is a vital legal tool that ensures your affairs are managed according to your wishes, even when you are not in a position to make decisions yourself. At Burd Ward Solicitors, we’re committed to guiding you through this crucial process with sensitivity, professionalism, and expertise.

For further information or to arrange an appointment, please contact us on 0151 639 8273.

As the festive season approaches, we at Burd Ward Solicitors wish to extend our warmest greetings and thanks to all our clients and partners.

With the holiday spirit in mind, we also understand the importance of spending quality time with family and friends. Therefore, we have adjusted our opening hours to reflect the season’s joy.

We’re delighted to hear that Kash Mahmood a solicitor and the legal aid supervisor in our family law department has been re-accredited to the Law Society’s Children Law Accreditation scheme.

The Law Society’s Children Law Accreditation is a recognised quality standard for practitioners representing children in children law proceedings.

The accreditation covers all types of children law work and is recognised by the Legal Aid Agency.

It’s a way for clients and professionals (such as guardians) to choose a qualified practitioner when a child needs representation.

Kash Mahmood, a solicitor in our family law department joined Burd Ward in June 2022 following the merger of his firm Solicitorhelp.com. Kash has been a solicitor for over 25 years and has been a member of the Law Society’s Children Panel for the last 20 years. He specialises in Child Care cases, dealing with sensitive and often complex proceedings brought by social services and the courts where there are concerns about the care offered to a child or children.

Outside of work Kash is deeply involved with St John Ambulance regularly volunteering his spare time to them. Most recently he completed the Northumberland Coast Mighty Hike for Macmillan Cancer Support raising over £1,300 for the charity.

For assistance in all aspects of of family law please contact Kash Mahmood on 0151 639 8273 or by emailing him directly at km@burdward.co.uk

We’re happy to announce that Jenna Ellison, a solicitor and head of our family law department has received the Law Society’s Children Law Accreditation

The Law Society’s Children Law Accreditation is a recognised quality standard for practitioners representing children in children law proceedings.

The accreditation covers all types of children law work and is recognised by the Legal Aid Agency.

It’s a way for clients and professionals (such as guardians) to choose a qualified practitioner when a child needs representation.

Jenna Ellison, a solicitor and head of our family law department re-joined Burd Ward Solicitors in 2022 having initially trained with us back in 2015.

A lecturer and author, Jenna brings with her a wealth of experience and knowledge from her previous experience working in a city firm to the Family department. Jenna has previously represented both males and females who have been victims of domestic violence and has supported them obtaining orders to protect not only their own safety, but that of their children and home.

Jenna is also very experienced in dealing with Private law proceedings where there is a dispute between the parents regarding where the children should live and when they should spend time with the non resident parent. Jenna’s experience representing children have allowed her to assist both parents come to a child focused arrangement. Jenna has also had experience acting for both Fathers and Mothers when children have not been returned and offers an approach that is timely and professional.

For assistance in all aspects of of family law please contact Jenna Ellison on 0151 639 8273 or by emailing her directly at je@burdward.co.uk

Congratulations to our own Nadya Makarova, who made the front page of the Liverpool Law Society magazine, August edition. You can read the latest issue online here.

Congratulations to our own Nadya Makarova, who made the front page of the Liverpool Law Society magazine, August edition. You can read the latest issue online here.

Nadya joined Burd Ward in November 2021 and heads our property team. With over 20 years’ experience dealing various property transactions including sales, purchases and refinancing as well as complex titles, high value transactions, first registrations and lease matters. Being bilingual, Nadya is able to assist clients from many Eastern European countries in addition to the local clients.

Nadya also handles some commercial property matters. If you would like Nadya to assist you in your Conveyancing transaction please call us on 0151 639 8273 or email her directly at nm@burdward.co.uk

The theme for this year’s International Women’s Day is #DigitALL. It raises the issue of innovation and technology for gender equality.

The theme for this year’s International Women’s Day is #DigitALL. It raises the issue of innovation and technology for gender equality.

Here at Burd Ward we also celebrate the women’s achievements and contributions that they make to the running of the business. We strive to support the innovation of the women that work within and support our business. Equally, we extend this to our clients also.

In the area of family law there is much to be celebrated in terms of significant milestones in family law which supports the progression of women’s equality and innovation. We acknowledge that there are still barriers to women being able to access the technology they need to progress, and we support all efforts made to rectify this.

Baroness Hale has been a champion for the rights of women and marginalized groups, and she has used her position to advocate for greater equality and access to justice in family law. Her contributions to family law have helped to shape the legal landscape in the UK and have had a significant impact on the lives of many individuals and families; a prominent legal scholar and jurist who has made significant contributions to the development of family law in the United Kingdom; she was appointed the first lady to the Law Commission and the first female law lord. Throughout her career, A key moment which highlights her dedication towards the equal rights of women was when she wore a coat of arms which read “women are equal to everything” in Latin at the House of Lords in 2004.

Baroness Hale was also involved in several notable family law cases during her tenure on the Supreme Court. In 2018, she delivered the leading judgment in the case of Owens v Owens, which concerned the grounds for divorce in England and Wales. In this case, she argued that the law on divorce needed to be reformed to allow for no-fault divorce, as the existing system was outdated and unnecessarily punitive.

In relation to this is the progress towards gender equality through the recognition of women’s right to divorce. The area of divorce has seen key changes in terms of the bias towards men, as originally, women were denied the right to divorce, and their marriages were often viewed as contracts that could not be broken. Women who sought a divorce were often stigmatized and faced social ostracism. The recognition of women’s right to divorce has given women the freedom to leave unhappy or abusive marriages and start afresh.

At Burd Ward we work in collaboration with charities such as Wirral Women and Children’s Aid and Tomorrow’s Women to assist women being able to access legal assistance.

We at Burd Ward Solicitors celebrate the achievements of gender equality and expansion of women’s rights in their totality.

Not everything in life works out the way people expect. The same applies to marriages and the divorce reform is a recognition of this. The Divorce, Dissolution and Separation Act 2020 has caused a shift within the divorce process, now removing the element of fault for divorces initiated after 31 March 2022.

Prior to the reform, the Matrimonial Causes Act 1973 placed a burden on the parties to prove the marriage broke down for one of the following 5 grounds:

Under the Matrimonial Causes Act 1973 there was also the option was for one spouse to request the other to pay their legal costs and the court fee. The court in such circumstances would bear in mind what caused the marriage to break down and if it was found to be by way of fault, it was common for the at fault spouse to incur the financial burden of the divorce costs. The shift to no-fault divorce removes the risk of one spouse having a cost order made against them on the basis of fault. Separating couples now can choose to share to costs to assist with the amicable breakup.

Even though the 5 grounds for divorce are no longer applicable, the couple still have to demonstrate that there has been an irretrievable breakdown in marriage, albeit not having to attach fault to one of the parties. This is now done by way of a statement and is sufficient on its own to procure the divorce, without the need for any further evidence.

The application for a divorce order can be made by one spouse, or both of them. The legal terminology for divorce has also had a revamp. What was previously known as ‘Decree Nisi’ is now changed to ‘Conditional Order’, and ‘Decree Absolute’ has now changed to ‘Final Order’. The reforms have cancelled out the opportunity to consent a divorce, allowing people to escape unhappy marriages without having to wait out the separation rule, or cause animosity between their former spouse by alleging fault.

In addition, the reforms have introduced a new 20 week cooling off period between the initial application for divorce proceedings and the conditional order. There is also a further cooling off period of 6 weeks and one day between the conditional order and final order. This awards the parties time to deal with any financial matters as discussed below.

While the aim of no-fault divorce is for the matter to be dealt with amicably, it is unsafe for the parties to assume that their financial position is automatically protected. The final divorce order (previously referred to as decree absolute) may legally end the marriage, but it does not end any financial commitments.

Therefore, it is important to seek legal advice and obtain a divorce financial order to protect your position at the time of the divorce and in the future. There are two types of court orders to award your finances protection: Consent Orders and Clean Break Orders. The latter is important for people with no current assets to consider, as any future assets one may acquire will be at risk of the former spouse making a financial claim to inherit a share of the same. A Clean Break Order will sever any financial ties and protect future assets. A Consent Order allows spouses with assets to create a legally binding financial agreement, dealing with how their assets will be divided. Once such an order is approved by the court, it will have the same effect as a Clean Break Order and sever financial ties after the current assets have been dealt with accordingly.

If you would like more information on finances and divorce, please do get in touch on 0151 639 8273.

We offer fixed fees for divorce and finance matters. In certain circumstances we are also able to offer legal aid.

There will be a chance to learn essential life-saving skills during a free event on Wirral next week.

There will be a chance to learn essential life-saving skills during a free event on Wirral next week.

A demonstration will be given by St John Ambulance volunteer and Family Law Solicitor, Kash Mahmood as part of the annual Restart a Heart campaign next Thursday (October 20) at our office Seaview Road in Wallasey between the hours of 2 and 5pm

To attend the session, email kash.mahmood@sja.org.uk to reserve a place.

Each session is free to attend and includes practical information on how to give cardiopulmonary resuscitation (CPR), how to understand the difference between a cardiac arrest and a heart attack, and how to deliver shocks to the heart with a defibrillator.

Jenna re-joins Burd Ward from The National Youth Advocacy Service (NYAS) who are a UK charity providing socio-legal services offering information, advice, advocacy and legal representation to children, young people and vulnerable adults. During her time at NYAS Jenna worked within the Legal Department and represented many children in both public and private law proceedings. Jenna has also assisted children making their own applications for contact with their siblings and provided assistance to children who are subject to care plans and special guardianship orders. Further to this Jenna has assisted young parents at pre proceedings meetings and assisted other young parents finding mother and baby units across England and Wales in order for them to be able to remain as a family unit. During her time at NYAS Jenna also worked as a Contact Facilitator within the contact centre and worked with families offerings supervised and supported sessions for children with non-resident parents, siblings and grandparents.

Jenna brings this wealth of experience and knowledge from her previous experience working in a city firm to the Family department. Jenna has previously represented both males and females who have been victims of domestic violence and has supported them obtaining orders to protect not only their own safety, but that of their children and home.

Jenna is also very experienced in dealing with Private law proceedings where there is a dispute between the parents regarding where the children should live and when they should spend time with the non resident parent. Jenna’s experience representing children have allowed her to assist both parents come to a child focused arrangement. Jenna has also had experience acting for both Fathers and Mothers when children have not been returned and offers an approach that is timely and professional.

Jenna has also represented parents in Public Law proceedings.

Jenna is also able to offer client advice in respect of Divorce and Financial matters.

Contact Jenna directly on 0151 351 5181 or at JennaEllison@Burdward.co.uk.